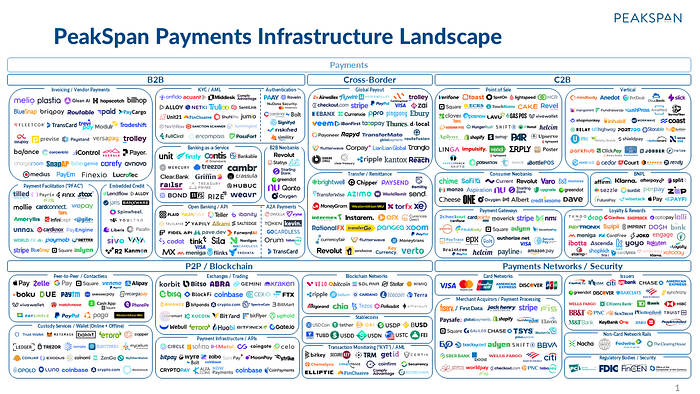

PeakSpan’s Payments Infrastructure Landscape

The payments stack is a complex and evolving system as the various domains of payment (e.g., B2B, cross-border, C2B, P2P) require tailored infrastructure for digitizing transactions. The B2B realm is among the most archaic in terms of payments digitization, still largely dominated by paper checks due to the complexity that accompanies the business payment lifecycle — from purchase order/invoice to AR/AP. Beyond the technology that simplifies B2B payments, there is also a wide array of embedded financial products that integrate into a business’s existing infrastructure to streamline access to financial services, thereby enhancing the customer experience and eliminating friction across multiple systems of record. Notably, we have highlighted PFACs that allows businesses to accept card payments as sub-merchants under the umbrella of the PayFac’s master merchant ID and Banking-as-a-Service vendors that allow non-bank businesses to offer banking services (e.g. checking accounts, debit cards, and loans) directly within their products. These are just two of many sub-categories of embedded financial products that have come to the forefront of the B2B universe.

Cross-border payments are conducted mostly through expensive and slow wire transfers, underscoring speed, transparency, and high fee structures as pain points for innovators to address. Blockchain-based payments have also emerged as a cheaper, faster, and more flexible alternative for many vendors in the cross-border remittance space to facilitate payments overseas (particularly in countries with less developed banking infrastructure).

On the other hand, the C2B space is hyper-competitive and has witnessed widespread technology adoption that increases customer conversion and retention, while also eliminating friction at the point of sale. Specifically, vertical SaaS vendors have focused on C2B payments as a previously commoditized revenue stream that they can “earn the right” to via a slick, easy to use, and sticky platform experience. These vendors are the ideal customer profile (“ICP”) of the aforementioned embedded finance providers in the B2B space, cutting across embedded credit, embedded payroll, and embedded procurement.

Finally, P2P and blockchain-based payments are the industry’s poster child for innovation. While the benefits of decentralized protocols have been widely substantiated, it will be interesting to track the vendors that prioritize i) the most seamless and integrated infrastructure for on-ramping/off-ramping between fiat and cryptocurrency and ii) transaction security and fraud identification to prevent illicit activity from corrupting the benefits of blockchain networks.

With payments at the forefront of all consumer and business workflows, infrastructure modernization has quickly become table-stakes for those trying to optimize productivity and offer a truly differentiated payments experience.